If we can't even be honest about the details, we'll never come to any sound solutions...

Five Falsehoods of the Debt Debate

by Daniel Flynn

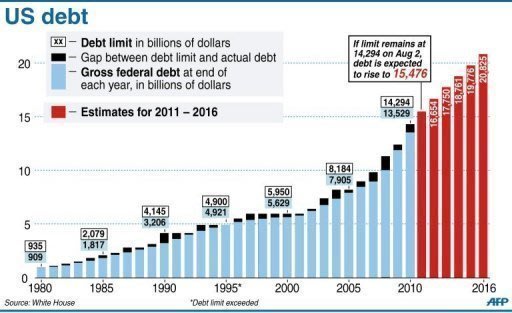

Incontinent spending put America $14 trillion in debt. The politicians who borrowed and spent us into debt want permission to borrow more so that they can spend more. And if they don’t get permission to borrow more money, they assure us that our debt woes will worsen.

Does this seem like a solution or a rationalization?

Washington is hooked on spending. Like other addicts, politicians tell lies to get their fix. Jonesing for more money, they insist that raising the debt limit is the best way to limit America’s debt.

Bad habits are tough to break. Surely, dishonesty about the problem doesn’t bring us any closer to a solution.

In the spirit of providing clarity through the haze of deceit, here are the five big lies the spending addicts tell to satiate their cravings for more of your money:

Lie #5 Americans Want a Tax Increase

“Eighty percent of the American people support an approach that includes revenues and cuts,” the president claimed Friday. “So the notion that somehow the American people aren’t sold is not the problem. The problem is members of Congress are dug in ideologically into various positions because they boxed themselves in with previous statements.” A poll released the previous day by Rasmussen showed that while a majority of Democrats want a tax increase as part of the deal, just 34 percent of Americans favor one in conjunction with raising the debt ceiling.

Lie #4 The Rich Don’t Pay Their Fair Share

Obama contended in his Saturday radio address that he merely planned on “asking the wealthiest Americans to pay their fair share” and that “we have to ask corporations and the wealthiest Americans to share in that sacrifice.” Leaving aside whether Obama intends to merely “ask” wealthy Americans for more of their money, there is the subjective question of what constitutes a “fair share.” A study by the Tax Foundation found that America’s richest tenth pays a higher percentage of income taxes than their counterparts in Germany, Japan, Great Britain, and every other similar industrialized nation. According to the Internal Revenue Service, the wealthiest five percent of Americans pays 59 percent of income taxes and the bottom fifty percent pays three percent of income taxes. Who, precisely, isn’t paying their “fair” share?

Lie #3 The U.S. Will Default If Congress Doesn’t Raise the Debt Ceiling

The president has repeatedly referred to a failure to raise the debt limit as “Armageddon.” But if the debt ceiling is not raised before it expires the first week of August, it’s not the end of Washington’s money—let alone the end of the world. The U.S. Treasury will claim revenues of aborevenues of $172 billion are enough to cover an interest payment of $29 billion. Not only are the revenues sufficient to pay the interest on the debt, but military salaries, Social Security, and Medicare, too. Dramatic spending cuts would necessarily follow a decision not to raise the debt ceiling. But it’s a lie to equate an act of fiscal responsibility (refusing to allow more borrowing) with one of recklessness (default).

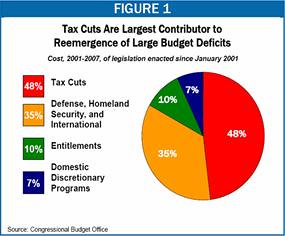

Lie #2 The Bush Tax Cuts Caused the Debt

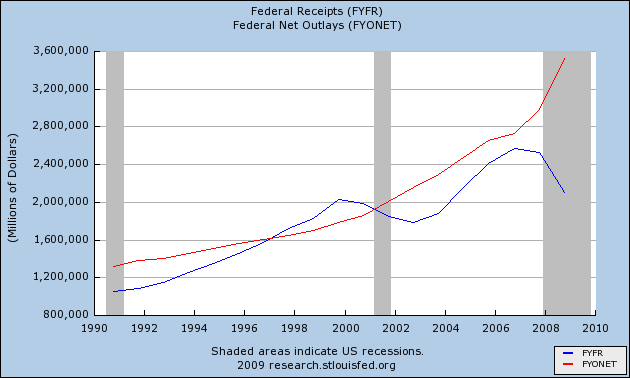

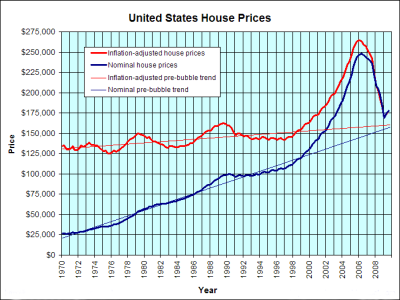

“It turns out that our problem is we cut taxes without paying for them over the last decade,” Obama claimed during Friday’s press conference. But revenues, which had been in decline immediately prior to the enactment of the Bush tax cuts, increased by more than a third soon after the top rates fell from 40 percent to 35 percent. While receipts declined dramatically in the aftermath of the financial/housing crisis, they had increased even more dramatically—$1.8 trillion in 2003 to $2.6 trillion in 2007—in the wake of the Bush tax cuts. As with the Harding/Coolidge, Kennedy/Johnson, and Reagan rate reductions, revenue counterintuitively increased following the Bush tax cuts.

Lie #1 Conservatives Who Oppose Raising the Debt Ceiling Are (Insert Insult Here)

Congresswoman Sheila Jackson Lee sees racism fueling opposition to raising the debt ceiling. Newsweek’s Tina Brown calls Republicans “suicide bombers.” Economist Paul Krugman calls the GOP “crazy.” But there are sensible reasons why an elected official might believe that taking on new debt would make a debt crisis worse, not better. “The fact that we are here today to debate raising America’s debt limit is a sign of leadership failure,” Senator Obamaexplained in 2006 regarding his vote against raising the debt ceiling. “It is a sign that the U.S. government can’t pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our government’s reckless fiscal policies.” Amen.