TeApocalypse

TeApocalypse

Replies sorted oldest to newest

The president’s FY 12 budget was voted down in the Senate 97-0.

The original debt-ceiling bill, put forward by the Democrats, totaled $0.00 in debt reduction.

In the House, 82 Democrats and all Republicans voted it down.

In S&P’s assessment, agency did not call for tax hikes, but a $4 trillion debt reduction

The presidential debt reduction committee recommended $ 4 trillion including tax revenues. Rand Paul agreed to it. Pelosi stated it was DOA in the House when she was still Speaker.

Rand Paul’s budget included $4.4 trillion in debt reduction, well above the minimum S&P requirement. Reid declared it DOA in the Senate.

Blaming the Tea party for all this is so ridiculous. If it's their fault after 2010, then it's Obama's fault BEFORE 2010.

Agreed.

The Stimulus was too small.

The BushIIe Tax Cuts should have expired.

OBama should not have signed the largest 2-year tax cut in history, which will now also be extended.

By going along with the BushIIe policies, OBama has extended the BushIIe Depression.

Keynes' theories as to government stimulating the economy have never worked --NEVER!

FDR's stimulus caused a major recession to become a major depression. Sound familiar! His own Secretary of Finance Henry Morgenthau agreed.

"We have tried spending money. We are spending more money than we have ever spent before and it does not work. And I have just none interest, and if I am wrong . . . somebody else can have my job. I want to see this country prosperous. I want to see people get a job, I want to see people get enough to eat. We have never made good on our promises. . . . I say after eight years of this administration we have just as much unemployment as when we started . . . . And an enormous debt to boot!"

It didn't work when Juan Peron tried it in Argentina. Between him and his first doxie, Evita, they converted one of the 12 richest nations into a barely second world one.

During the 1990s, Japan tried stimulus spending on everything including the infrastructure to the tune of 240 percent of their GDP and it didn't help.

Until recently, the EU tried stimulus, with obviously disastrous results. Still, the left insists trying it again.

The stimulus bill was nearly $800billion with about $300billion of it in tax cuts. Of the remaining $500billion, about $150billion remains to be spent. So $350billion in direct spending and $300billion in tax cuts, caused the GDP to shift 12% in only 3 quarters. That is a huge success.

The stimulus bill was nearly $800billion with about $300billion of it in tax cuts. Of the remaining $500billion, about $150billion remains to be spent. So $350billion in direct spending and $300billion in tax cuts, caused the GDP to shift 12% in only 3 quarters. That is a huge success.

You forgot the 2.5% going to the imaginary precincts in Arizona that nobody can find.

Were is that GDP now my friend?

Good job Biden/ Good job Obama, ATTAboy(s)

What a joke!!

Skippy![]()

The stimulus bill was nearly $800billion with about $300billion of it in tax cuts. Of the remaining $500billion, about $150billion remains to be spent. So $350billion in direct spending and $300billion in tax cuts, caused the GDP to shift 12% in only 3 quarters. That is a huge success.

Not close, NO CIGAR! Manufacturing played a large part in the GDP growth. Unfortunately, it was production increase with little new employment.

Dittohead is slurping the kool aid by the yard glass again!

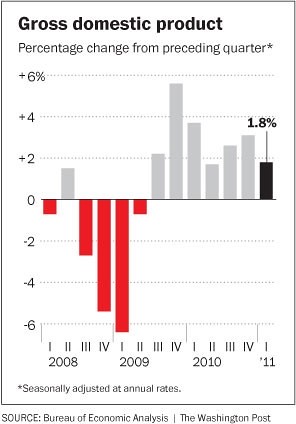

US GDP growth, percent change, QoQ

The American Reinvestment and Recovery Act was signed into law during the first quarter of 2009.

And I accept your apology.

Just because says its so, he thinks he thinks that makes it so.

Ditzy is under the delusion that if he says its so, its so!

From the Department of Commerce's Bureau of Economic Analysis. The results are for 2010. However, note the end footnotes that state the leading contributors to real GDP growht from 2007 to 2009 are the same as 2010.

The contributors were durable goods manufacturing, retail trade, insurance and fiance. None being big stimulus targets. Sorry, Ditzy!

"For the revised years of 2007—2009, U.S. GDP by state is nearly identical to GDP by industry except for small differences resulting from the GDP–by–state accounts' exclusion of overseas Federal military and civilian activity (because it cannot be attributed to a particular state). The GDP–by–industry statistics are identical to those from the 2010 annual revision of the NIPAs, released in July 2010. However, because of revisions since July 2010, GDP in the NIPAs may differ from U.S. GDP by state.

Durable–goods manufacturing led the recovery in U.S. real GDP by state in 2010; it was the leading contributor to real GDP growth in seven of the eight BEA regions and in 29 states. Durable–goods manufacturing contributed more than two percentage points to growth in Indiana and Oregon and more than one percentage point to growth in Michigan, Wisconsin, and Tennessee.

Retail trade and finance and insurance were also leading contributors to real GDP growth. Retail trade contributed to growth in all eight BEA regions and in every state, and was the leading contributor in Oklahoma and Florida. Finance and insurance was the leading contributor to real GDP growth in five states, contributing more than one percentage point to growth in New York and Connecticut. "

Keynes' theories as to government stimulating the economy have never worked --NEVER!

FDR's stimulus caused a major recession to become a major depression.

A second cyclical downturn officially began in May 1937 when FDR, always a fiscal conservative, mistakenly thought the economy had become self-sustaining and slashed public spending programs to balance the budget. These harsh and premature spending cuts caused another severe recession that ended after 13 months in June 1938.

Even in this severe downturn, annual GDP did not fall back below its 1929 peak. And although many suffered and most economic measures did fall back below their 1929 levels, not one fell anywhere close to its March 1933 low. For example, although industrial production fell sharply in the 1937-38 recession, at its low point, in April 1938, it remained 49 percent above its level of March 1933.

When the economy again contracted sharply in late 1937 and early 1938, FDR quickly reversed course and rapid growth immediately began again. GDP soared by 10.9 percent in 1939 and industrial production soared by 23 percent.

http://www.ourfuture.org/blog-...0603/fdr-failed-myth

In 1937, after five years of sustained economic growth and a steadily declining unemployment rate, the Roosevelt Administration began to worry more about possible inflation and the size of the federal deficit than the ability of the economy to sustain the recovery. As a consequence, in the fall of 1937, FDR supported those in his administration who advocated a reduction in federal expenditures (i.e. stimulus spending) and a balanced budget. The results — which included a massive reduction in the number of people employed by such programs as the WPA — were catastrophic. From the fall of 1937 to the summer of 1938, industrial production declined by 33 percent; wages by 35 percent; national income by 13 percent; and not surprisingly, the unemployment rate rose by roughly 5 percentage points, with an estimated 4 million workers losing their jobs.

The economic downturn caused by the decline in federal spending was commonly referred to as the “Roosevelt recession,” and to counter it, FDR asked Congress in April of 1938 to support a substantial increase in federal spending and lending. Unlike the current situation, Congress backed FDR’s request, and as a result, the recovery was soon underway again.

Equally important, the lessons drawn from the 1937-38 recession convinced FDR that deficit spending and monetary expansion were critical to economic recovery. In essence, the Roosevelt Administration, through hard experience, finally endorsed Keynesian economics . . .

The contributors were durable goods manufacturing, retail trade, insurance and fiance. None being big stimulus targets. Sorry, Ditzy!

Durable–goods manufacturing led the recovery in U.S. real GDP by state in 2010; it was the leading contributor to real GDP growth in seven of the eight BEA regions and in 29 states. Durable–goods manufacturing contributed more than two percentage points to growth in Indiana and Oregon and more than one percentage point to growth in Michigan, Wisconsin, and Tennessee.

Retail trade and finance and insurance were also leading contributors to real GDP growth. Retail trade contributed to growth in all eight BEA regions and in every state, and was the leading contributor in Oklahoma and Florida. Finance and insurance was the leading contributor to real GDP growth in five states, contributing more than one percentage point to growth in New York and Connecticut. "

You proved my point.

Where do you think the durable goods go? The economic stimulus helped drive demand, which produced the durable goods uptick. Stop obsessing over my intellect and try to grasp the larger concepts.

Ditzy, you really have no idea what you're talking about, do you! The stimulus was not targeted durable goods, except for the clunker program. Which was a short term boom and bust.

![]()

Where do you think the proceeds of $300billion in tax cuts landed???

Or the $100billion in grants to state and local education???

Think about that but dont bother responding, I really dont think you're capable of understanding.

![]()

Where do you think the proceeds of $300billion in tax cuts landed???

Or the $100billion in grants to state and local education???

Think about that but dont bother responding, I really dont think you're capable of understanding.

How about the 300+ Billion given to China for the study of why Chinese citizens smoke?

And the investment in thier mass transit and other Chinese programs.

Makes a lot of sense, borrow money from the Chinese. Pay interest on that money. Then turn around and give them aid. What the H*LL is going on.

Skippy![]()

How about the 300+ Billion given to China for the study of why Chinese citizens smoke?

And the investment in thier mass transit and other Chinese programs.

Makes a lot of sense, borrow money from the Chinese. Pay interest on that money. Then turn around and give them aid. What the H*LL is going on.

Skippy![]()

STOP MAKING STUFF UP!!!

You're validating the stereotypes of the Tea Party membership.

Ditzy,

The $100 billion to the states for education wouldn't have increased the 2009 GDP. In general, since the advent of the Department of Education, US education hasn't improved. Only Switzerland spends more than we do.